Analysis of the Heco algorithm stable currency BOC known as BAC2.0

- Guest Posts

- January 26, 2021

Looking back at the development trend of the crypto currency industry in 2020, the price of BTC has experienced a sharp rise and fall from 10,000U to 3800u to 42,000U. The defi, a new hot spot in the market, has risen strongly. Continuous market hotspots have inspired tokens prices in different sectors to hit historical highs one after another.. With the start of 2021, many investors have also started a new layout. In addition to mainstream tokens such as BTC, they are also focusing on the algorithmic stablecoins in the DeFi ecosystem, and hoping to get a share of it in the new year.

The development of algorithmic stablecoins

As the key to supporting the conversion between legal currencies and cryptocurrencies, stablecoins are measurement units of the value of cryptocurrency circulating in the market. From the USDT issued against the pledge of USD assets to the rise of the DeFi ecosystem, people have never stopped paying attention to algorithmic stablecoins in the crypto world.

Currently, algorithmic stablecoins are divided into two categories, one is AMPL, and the other is composite stablecoins such as ESD/BAC. Since the concept of rebase was proposed by AMPL, stablecoins related to it have emerged in endlessly. After several rounds of iterations, composite stablecoins headed by BAC occupy a position that cannot be ignored in the market. As a rising star, Blongcash has attracted the attention of investors from the moment it was released, and is known as BAC 2.0.

About Blongcash

Blongcash is a composite algorithm stablecoin protocol built on the Huobi ecological chain (Heco). Through this protocol, the supply of tokens is dynamically adjusted to meet the stable value of BOC. Different from other projects, Blongcash has adopted a fairness model called “Four No”: no pre-mining, no reservation, no cornerstone, and no team share to ensure the fair start of the project.

1. Three basic tokens to ensure stable value

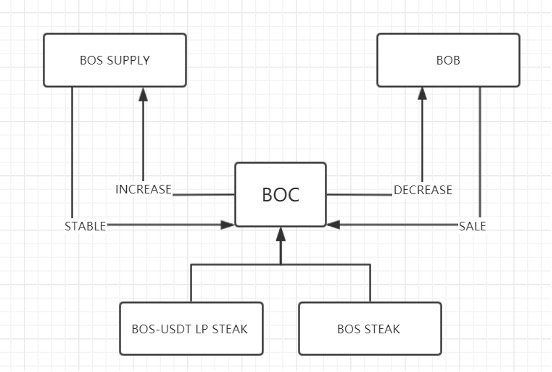

Similar to BAC, the Blongcash protocol adopts the same three tokens compounding method to ensure the stable value of the stablecoin BOC.

Blongcash (BOC): As the basic stablecoin in the entire protocol, its value is anchored to the US dollar.

Blong Share (BOS): BOS is issued as the basic shares of the protocol. When the demand for BOC increases, the value of BOC is controlled by increasing BOS’s supply. It can be understood as the “Federal Reserve” of the digital currency industry, used to issue additional “currency”.

BlongBonds (BOB): BOB is issued as the basic bond of the protocol. When the value of BOC decreases, the platform will repurchase and auction BOB to return the value of BOC to a constant position. As shown,

2. Two major innovations to ensure long-term stable operation of Blong.Cash

(1) Fair governance mechanism

In terms of project governance, BOC adopts the “Four No” fair model introduced in the previous article to ensure that that the price of the token is not affected by external selling pressure. Not only that, before the project officially starts mining, the developer will only generate 1,000 BOC and 1 BOS, and use 300 BOC to pair USDT to provide initial liquidity. The remaining 700 BOC will be destroyed. At the same time, the BOC contract management authority will be destroyed or given a time lock to ensure fair operation of the contract.

In addition, for BOC ecological governance, Blongcash adopts a strict community management model, and any operation resolution can only be resolved by transparent voting.

(2) Shorten the Rebase cycle and support dual-currency pledge mining

Compared with BAC, the difference of Blongcash is that the original 24-hour rebase mechanism of BAC is changed to 8-hour rebase. The upper limit of BOC output for each Rebase is 10% of the circulating quantity of BOC. The protocol will control the upper limit of BOB purchases to the same amount, so as to avoid additional issuance of BOC or excessive deposits, resulting in large price fluctuations, making the project more sustainable and participating users more profitable .

At the same time, in terms of token pledge and distribution, the Blongcash protocol adopts the dual pledge method of BOS-USDT LP and BOS tokens to obtain the BOC issued by Rebase. When the system generates BOC, 40% will be allocated to BOS pledgers and 60% to BOS-USDT LP providers.

Note: The total number of BOS is 100,000, all of which are produced through mining, of which:

- 75,000 BOS are produced on average by the BOC_USDT LP mining pool within 180 days, that is, 416 BOS can be mined per day

- (2) 25000 BOS are averagely produced by the BOS_USDT LP mining pool within 180, that is, 139 BOS can be mined per day

As an upgraded version of BAC, BlongCash’s model of no pre-mining, no reservation, no cornerstone, and no team share is undoubtedly the best driving force for the community. Technically, powered by Heco, it has the unique advantages to create an algorithmic stable coin ecosystem. Compared with BAC whose trading volume exceeded 100 million U.S. dollars in six days, BOC, with its more complete economic model and the support of a wider community of users, will surely subvert the existing pattern of stablecoins.

The test of technology and humanity of algorithmic stablecoins without physical asset pledge is undoubtedly unprecedented. Although we cannot predict the future of blockchain technology and algorithmic stablecoins, the pursuit of interests and technological exploration have never stopped. We always believe that Blongcash will be an indispensable part of the long chapter of algorithmic stablecoins.