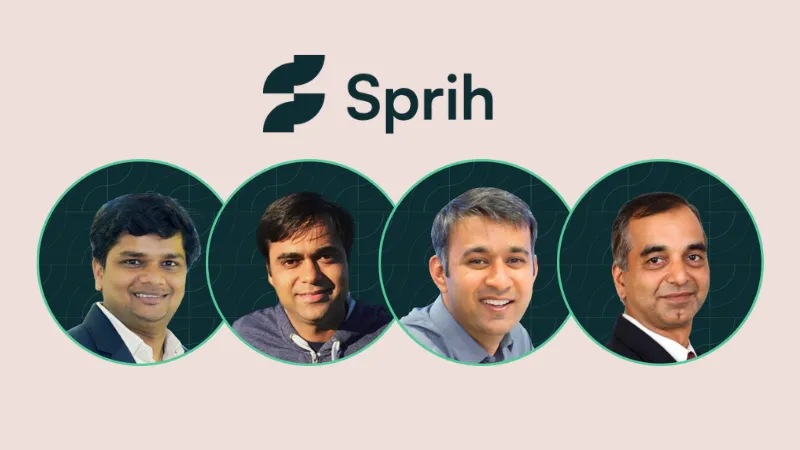

Leo Capital, an early-stage startup capital firm, sponsored a $3 million fundraising round for the carbon emission management platform Sprih.

According to the company, the money will be used to grow the network of partners, hire people to create artificial intelligence (AI) models that address climate-related concerns, and expand sales abroad.

“We are trying to bring all the climate data in one place…and for that, we are going to keep investing in research and product development,” cofounder and chief executive Akash Keshav told ET.

The company was founded in 2022 and provides organizations with an end-to-end software platform to make the process of monitoring, reporting, and comparing emissions across their supply chain and activities against industry standards easier.

Since these nations have regulations pertaining to climate change, the company intends to grow its customer base in India and enter the US, Europe, and other international markets. It is now running trials in the United States. “These countries have committed to reducing their carbon footprint, and the carbon footprint will only decrease when corporations truly start taking it seriously,” he stated.

“This year, our focus is to expand globally, and we are definitely targeting around 40-50 customers globally,” he said. Currently, Sprih has more than 12 customers, including Indigo Paints, Hero MotoCorp, Arvind SmartSpaces, Espi Industries, and InfoBeans.

“As a company we would like to cross $6-7 million in terms of revenue in a few years,” he added.

Partner at Leo Capital Ravi Srivastava commented on the investment, saying, “With increasing top-down commitments towards net zero, sustainability is steadily becoming a crucial part of businesses’ growth agenda. However, without any prior framework, most companies struggle to develop a viable path to their sustainability goals.”

The early-stage venture capital firm RTP Global led a $8.7 million fundraising round for climate tech startup Varaha, which helps offset greenhouse gas emissions, according to an ET story on February 22.

Omnivore and Orios Venture Partners, two longtime investors, also took part in the round. Norinchukin Bank, a cooperative bank in Japan, took part in the round as well.