Startup Chestnut Gets $160 Million to Increase Projects for Forest Carbon

- Business

- February 13, 2025

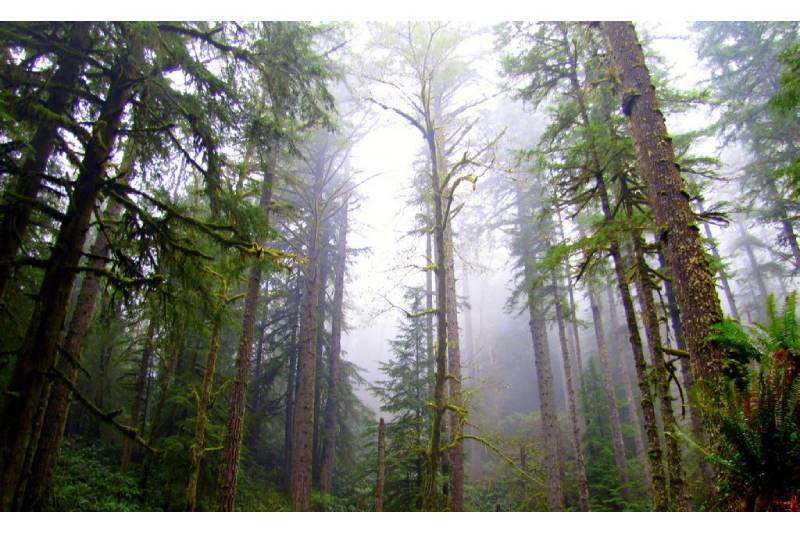

Startup Chestnut Carbon has secured a $160 million investment to plant, restore, and manage forests on degraded land, producing high-quality carbon credits. Microsoft Corp. and other large firms will purchase these credits.

The objective is to develop trustworthy nature-based credits that tackle issues that have undermined confidence in the carbon market.

“The Series B round, led by the Canada Pension Plan Investment Board and Cloverlay Investment Management LLC, comes less than a month after Chestnut signed an agreement with Microsoft to provide 7 million tons of carbon removal credits. That’s the second-largest carbon removal agreement the tech giant has struck.”

Carbon removal has become increasingly important for businesses looking to satisfy sustainability goals as a result of AI-driven data centers’ rising energy demands.

Nature-based carbon projects have come under fire for generating erratic credits, which has damaged market trust. Instead of depending on outside landowners, Chestnut plans to address this “credibility crisis” by purchasing degraded lands and actively managing restoration initiatives.

“We can deliver the credits and at scale,” said Chief Executive Officer Ben Dell, who is also the founder and managing partner of energy investor Kimmeridge Energy Management Co.”

One issue with nature-based solutions is leakage, which occurs when emissions move to other locations as a result of changes in land usage. Although more permanent, engineered solutions are still expensive and underdeveloped. Scalable and reasonably priced carbon removal is essential, especially since “tech giants like Microsoft find it more difficult to meet their ambitious climate goals due to the artificial intelligence boom.”

Following Dell’s difficulties locating high-quality credits for purchase, Chestnut was established. He said, “I didn’t want any PR risk of buying a low-quality credit,” highlighting the fact that companies are prepared to pay extra for trustworthiness.

In six U.S. states, the company has already purchased 35,000 acres, concentrating on areas with low wildfire danger and fast forest growth. “In two years, Chestnut will start delivering its first afforestation credits,” Dell said.

In the rapidly changing carbon credit market, Startup Chestnut is establishing itself as a leader by emphasizing accurate carbon tracking and sustainable land management. The carbon market is predicted to reach $1 trillion by the middle of the century, indicating that the business might grow substantially under the correct circumstances.