July 23, WHO notified and defined the 2022 monkeypox outbreak as a “global public health emergency”. On August 4, the latest data released by the US Centers for Disease Control and Prevention showed that approximately 26,800 monkeypox cases have been reported worldwide (on the day of the WHO announcement, about 16,000 cases were reported in 75 countries around the world), and the United States has reported more than 7100 cases. In just 10 days, the number of monkeypox cases has increased by more than 10,000 worldwide. Monkeypox vaccines and detection reagents have become strategic materials that countries are scrambling to reserve.

Bavaria Nordic, known as “the only manufacturer in the world for producing qualified monkeypox vaccine”, has received orders from just a few countries in the past few years. After the monkeypox outbreak, the company has raised its earnings forecast for the current fiscal year several times and is considering extending the production time to 7 x 24 hours.

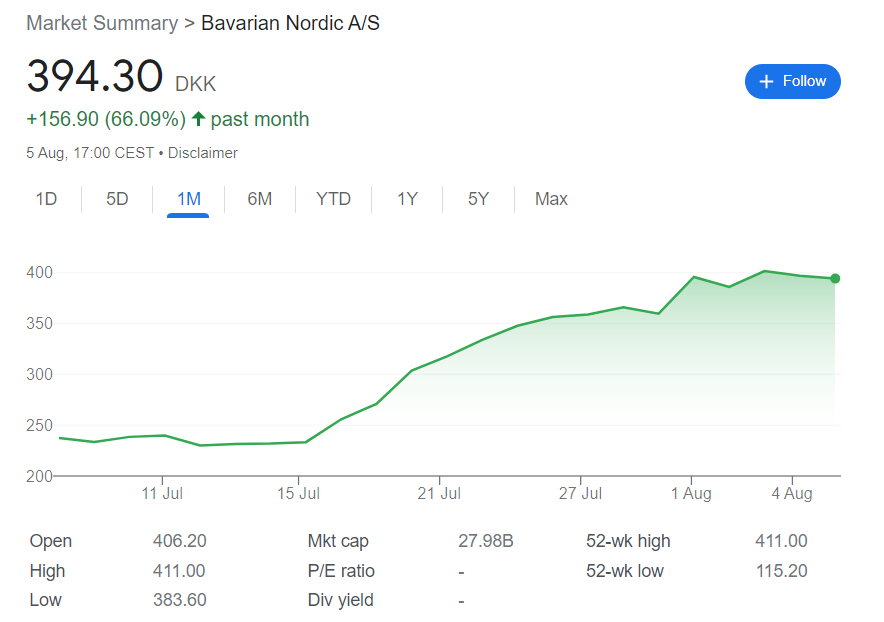

Affected by the increase in demand, the share price of $BAVARIAN NORDIC(BVNRY)$ also hit a record high this week, reaching 19.31 USD/share.

In addition to vaccines, nucleic acid and antigen detection reagents are still conventional weapons for rapid screening of monkeypox infection, similar to the prevention and control of the new crown epidemic. Greg Gonsalves, an expert in infectious disease and material policy modeling at Yale University, said on social media that The United State Department of Health and Human Services has no testing resources for monkeypox outbreaks, and the European region where monkeypox originated also has Strong demand for detection reagents procurement.

WeTrade Group(WETG.US) announced a potential strategic partnership with Jiqing biomedical Technology Co. Ltd on 5th August, plans to exclusively sell Jiqing biological nucleic acid detection (RT-LAMP) and antigen detection (colloidal gold method) reagents worldwide, aiming to develop domestic and international markets.

Pharmaceuticals are not like general merchandise retailers, every new product has to obtain approvals and production permits before proceeding to production and sales. At present, more than 30 companies in China have been certified by EU for their monkeypox virus detection products, but most of them are in the preparatory stage, and few companies generate income.

We can see from the previous overseas sales experience of new crown detection kits and antigen detection reagents: After registration, the detection reagent companies, which keeps up with the production capacity can benefit. For those, which the business development is slow, and the production capacity cannot keep up with the detection reagents definitely lose. Thus the hardest part for middle and small companies is whether they can open up overseas sales!

Previously, domestic testing reagent companies sold overseas, either directly to G-terminal customers such as the government and WHO; or resold to overseas consumers by distributors with overseas distribution models,. However, for small and medium-sized testing reagent companies, it is difficult to reach G-terminal customers. Distributors are usually “not interested” in small-scale orders. Even if they are willing to accept orders, they will preset a higher proportion of profit sharing, which is not correspond to the small enterprises’original intention for costs control. WeTrade Group, which owns the first international system in the field of global micro-business cloud intelligence, just solved the above difficulties for Jiqing Bio.

On the one hand, WeTrade Group, as an e-commerce SaaS company with a global layout, can use its own overseas channels to occupy the European and American markets rapidly with its nucleic acid and antigen kits as soon as Jiqing Bio gets the approval; On the other hand, the company can also utilize its own “private domain” to reach terminal consumers by social fission for achieving the perfect combination of

“people, goods, and industries”, which will save distribution costs for Jiqing, as well as maximize the company’s profits.

For WeTrade Group, the potential cooperation with Jiqing Bio to enter the detection reagent track is a breakthrough in the scenarios following micro-business, tourism, hospitality, short video live broadcast, aesthetic medicine, and traditional retail, which will accumulate valuable project experience for WeTrade Group, as well as improve the brand reputation. With the increasing breadth of industry ecological empowerment and the continuous expansion of overseas coverage in the future, the number of customers of WeTrade is expected to achieve “geometric” growth. Investors who know SaaS must know that the number of customers and the renewal rate are two key factors for the company’s profitability. By ” Cross-Border ” cooperating with Jiqing Bio , the customer base of WeTrade Group has a good growth momentum, which could be the main reason for the company’s stock price surge on the 5th August.